2020-2021 Maui County Tax Rates

Posted by Island Sotheby's International Realty on Thursday, May 21st, 2020 at 2:37pm

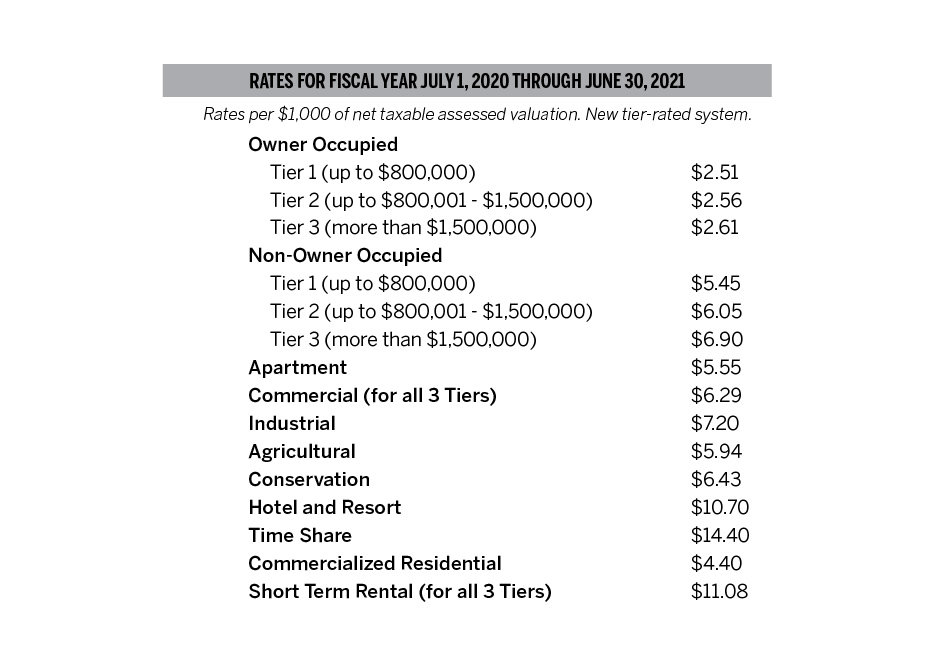

The new 2020-2021 Maui County real property tax rates are in for the fiscal year of July 1, 2020, to June 30, 2021. Please be sure to check out the graph below to find out how these apply to you and your properties. We want to make sure that every Maui property owner has all the information they need on important dates coming up and access to any resources that can assist them.

-

Property is classified based upon its highest and best use.

-

Properties receiving homeowner exemptions, condominiums, permitted bed and breakfasts and permitted transient vacation rentals are exceptions.

-

Properties which have been granted a homeowner exemption are classified as Homeowner.

-

Condominiums are classified upon consideration of their actual use (Apartment, Commercial, Hotel / Resort, Timeshare, Homeowner).

-

Properties which have been granted a bed and breakfast permit, a transient vacation rental permit, or a conditional permit to operate a transient vacation rental are classified as Commercialized Residential

Important dates to remember overall are:

- DECEMBER 31: Deadline for filing exemption claims and ownership documents that affect the tax year.

- AUGUST 20: First half-year tax payment due.

- FEBRUARY 20: Second half-year tax payment due.

For additional information check the county website https://www.mauicounty.gov/755/Classification-for-Tax-Rate-Purposes

Leave A Comment