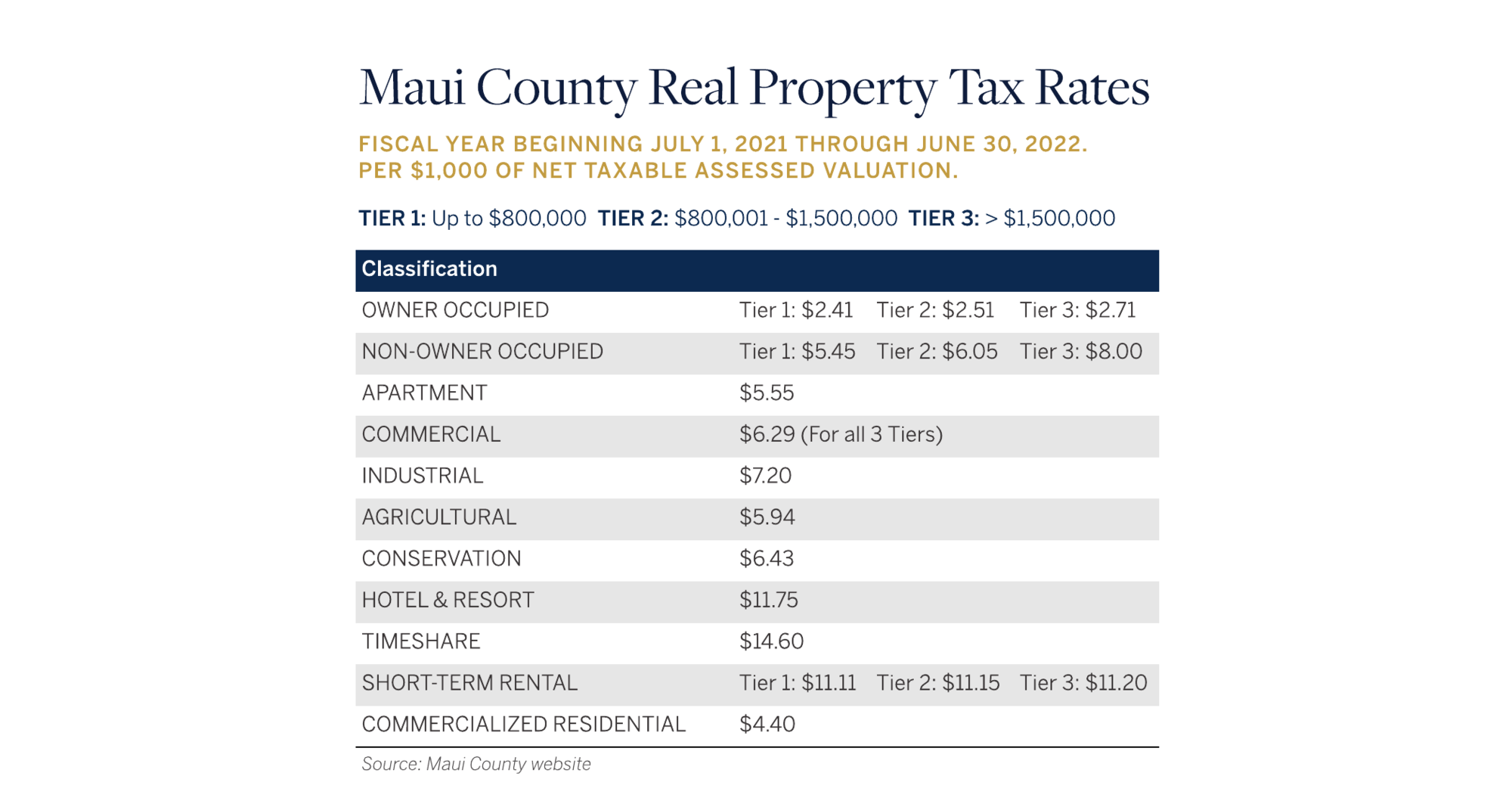

Maui County Real Property Tax rates for fiscal year beginning July 1, 2021 - June 30, 2022

Posted by Island Sotheby's International Realty on Friday, June 11th, 2021 at 6:56am

The Maui County Real Property Tax rates have been updated for the upcoming fiscal year. Property is classified based upon its highest and best use. Properties receiving home exemptions, condominiums, permitted bed and breakfasts and permitted transient vacation rentals are exceptions. Condominiums are classified upon consideration of their actual use (Non-owner-occupied, Commercial, Short-term rental, Timeshare, Owner-occupied).

- July 1—Tax year commences. Taxes are calculated based upon January 1 assessed values and fiscal year tax rates.

- July 20 — First half of fiscal year tax bills mailed.

- August 20 — First half of fiscal year tax payments due.

- September 1 — Deadline for filing dedication petitions.

- December 1 — Condominium AOAO use declaration.

- December 31 — Deadline for filing circuit breaker applications for the next fiscal year.

- December 31 — Deadline for filing exemption claims and ownership documents.

- January 1 — Assessed values established for use during the next tax year.

- January 20 — Second half of fiscal year tax bills mailed.

- February 20 — Second half of fiscal year tax bills due.

- March 15 — Assessment notices mailed.

- April 9 — Deadline for filing appeals.

- May 1 — Certified assessments forwarded to the County Council for budget purposes.

- June 20 — Tax rates established by the County Council

Helpful links

HOW TO CALCULATE REAL PROPERTY TAXES

REAL PROPERTY ASSESSMENT DIVISION

Leave A Comment