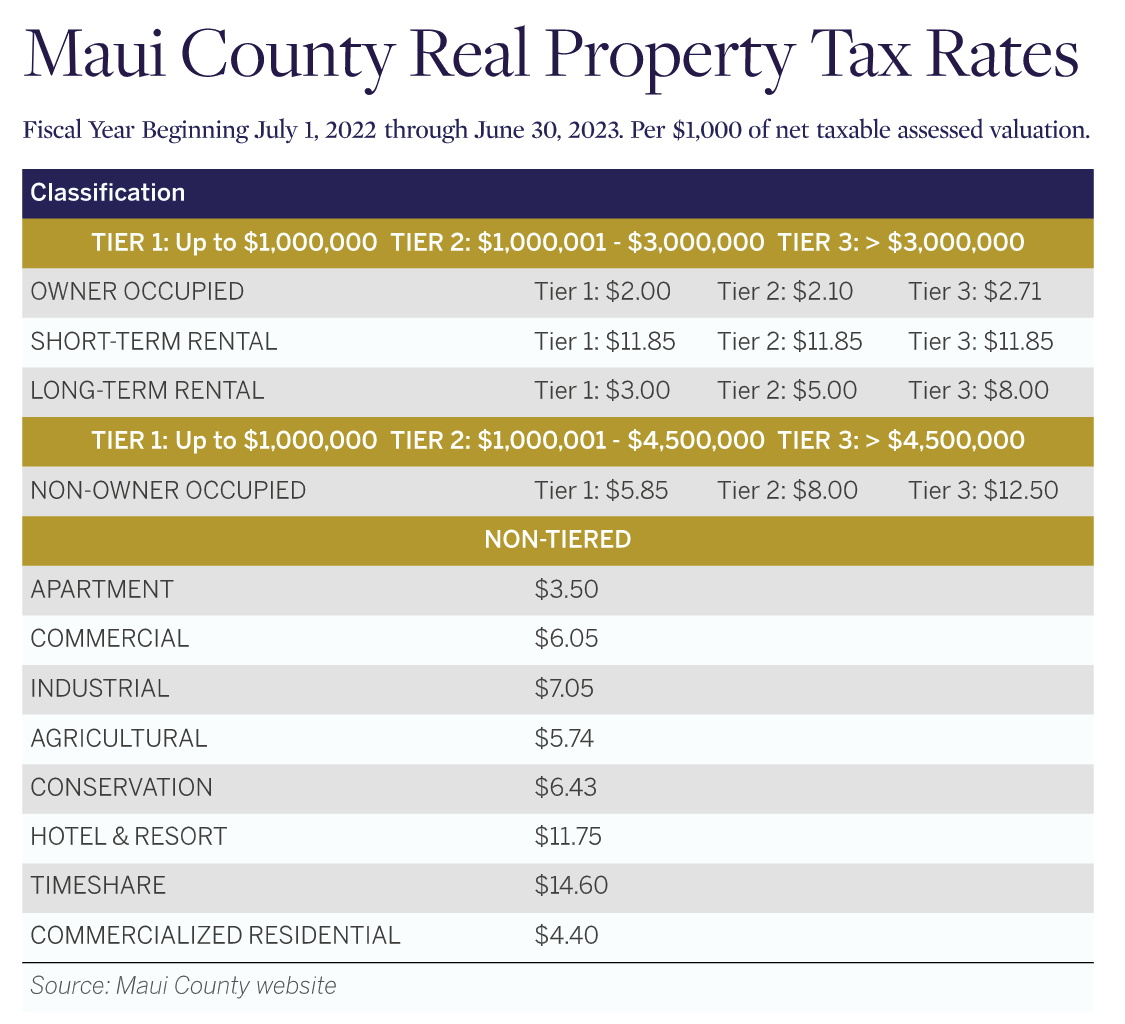

The Maui County Real Property Tax rates have been updated for the upcoming fiscal year. Property is classified based upon its highest and best use. Properties receiving home exemptions, condominiums, permitted bed and breakfasts and permitted transient vacation rentals are exceptions. Condominiums are classified upon consideration of their actual use — Non-owner-occupied, Commercial, Short-term rental, Long-term rental (new classification), Timeshare, Owner-occupied.

Dates to Remember

- July 1—Tax year commences. Taxes are calculated based upon January 1 assessed values and fiscal year tax rates.

- July 20 — First half of fiscal year tax bills mailed.

- August 20 — First half of fiscal year tax payments due.

- September 1 — Deadline for